What is whole life insurance?

Whole life insurance

What is whole life insurance? – Whole life insurance, sometimes called “ordinary life,” or “straight life”, is a life insurance policy guaranteed to remain in force for the insured’s whole lifetime, giving needed premiums or to the maturity date.

A life insurance policy represents a contract between the insurer and the insured. As long as the contract terms are met, the insurer will pay the policy’s death advantage to the policy’s beneficiaries when the insured passes.

Because whole life policies are guaranteed to remain in force as long as the needed premiums are paid, the premiums are typically much higher than those of term life insurance, where the premium is fixed only for a limited term.

Whole life premiums are fixed, based on the age of the problem, and usually don’t increase with age.

The insured party typically pays premiums until death but for limited pay policies, which may be paid in 10 and 20 years, or at age 65.

Whole life insurance belongs to the cash value category of life insurance, including variable life, universal life, and endowment policies.

Whole life insurance Key Facts

- Whole life insurance is for the insured’s life, in contrast to term life insurance, which lasts only for a certain number of time.

- Whole life insurance pays out to beneficiaries or beneficiaries on the insured’s passing, as long as the insurance policy is in effect at the time of death.

- Whole life insurance includes an element of cash savings that the policyholder can take advantage of or draw money from.

- A cash-value life insurance policy usually is rewarded with a fixed interest.

- Interest and principal on outstanding loans can reduce the death benefit.

Example of Whole Life Insurance

For insurance companies, the accumulation of cash value decreases their net risk.

For instance, ABC Insurance issues a life insurance policy of $25,000 in the name of Kevin, the policy owner and the insured.

In time the value of the policy increases to $10,000 in the event of death. Kevin’s passing, ABC Insurance will pay the entire death benefit of $25,000.

The firm will only be able to realize an amount of loss of $15,000 because of the $10,000 in cash value.

The risk amount in question was $25,000 in the event of the insured’s death; it was only $15,000.

If you are the first to purchase life insurance, the policy could be more expensive than those for a term insurance policy with similar coverage.

The cost is a fixed amount over the duration that the insurance policy will last. If you bought the term life insurance policy and then renewed it later in life, the price of the renewed policy will be higher than the amount you’d continue to pay on the total term life insurance plan.

For specific total life insurance plans, you can pay the premium in a shorter timeframe, for example, two years until 65.

Therefore, the cost for renewing a term insurance policy may be higher than those of a traditional life insurance policy.

Since whole life insurance policies also provide tax-free cash value throughout the term that they are in, the policies can be considered investments.

You can withdraw funds to pay for college tuition, purchase automobiles, or renovate a home based on the policy’s terms.

The amount you can withdraw is contingent upon your premium and the total amount you’ve already paid.

If you’re able to take out more than the cash value, you’ll be required to pay tax for the amount that is higher than your cash amount.

If you decide to take out a small portion of the cash from your life insurance policy, it will lower the death benefit paid to the beneficiaries. If you decide to withdraw the total cash value of your policy, it will be cancelled.

You may also have the possibility of borrowing on the value in cash of your complete life insurance policy.

The loan will earn interest until the loan is paid back. You can pay off the loan on your own or wait until you are ready to get the loan paid off by using funds from the death benefit you receive.

How Much Is Whole Life Insurance?

The cost of life insurance can vary and is based on various variables, including the age of the insured, their occupation and medical record.

Senior applicants generally are more expensive than younger ones. Health-conscious applicants with a good health history usually have higher rates than those with a history of health issues.

The face value of insurance is also a factor in how much the policyholder has to pay; the more face value and the greater the cost.

It is interesting to note that certain companies have more excellent rates than others regardless of the individual who applies and risk profile.

It’s also important to note it’s the case that, for the same level of protection, the whole-life insurance policy is much more costly as compared to term insurance.

What Is Modified Whole Life Insurance?

Modified Whole Life Insurance is permanent life insurance where premiums rise after a certain period. In most cases, premiums rise in the first five to 10 years but remain the same after that. However, the traditional whole life insurance premiums are the same throughout the plan.

Also Check:

- What is Umbrella insurance?

- Why USAA For Car Insurance

- How Much is Renters Insurance

- What is Gap Insurance

- What is SR-22 insurance

- What is Comprehensive Insurance

- How Allstate Accident Insurance Works

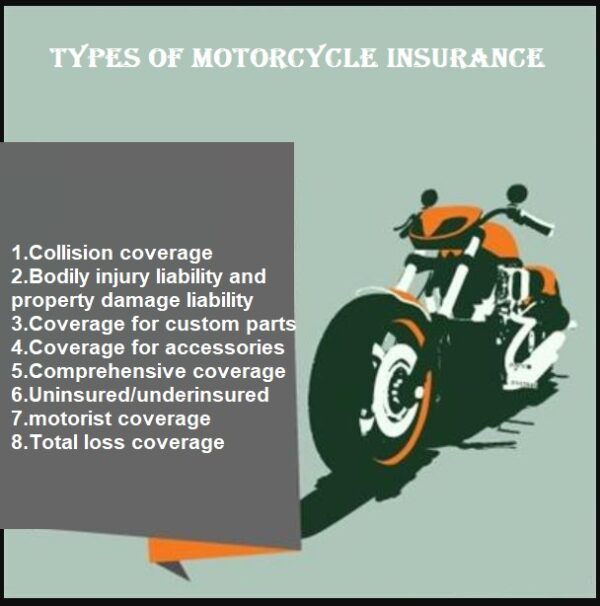

- Best Motorcycle Loans

- Best Motorcycle Accident Lawyer

- What is Term Life insurance?

- What is Accidental Death Insurance?

- What is Liability Insurance?

- What Is Supplemental Life Insurance?

- What is Mortgage Insurance?

I am Jack. Since 2016, I’ve been a blogger, and I adore writing. I greatly enjoy writing about Bikes, Motorcycles, ATVs, technology, and money. I also write about health and fitness. I maintain numerous blogs, including https://allbikeprice.com. allbikepriceinfo@gmail.com is how you may get in touch with me.